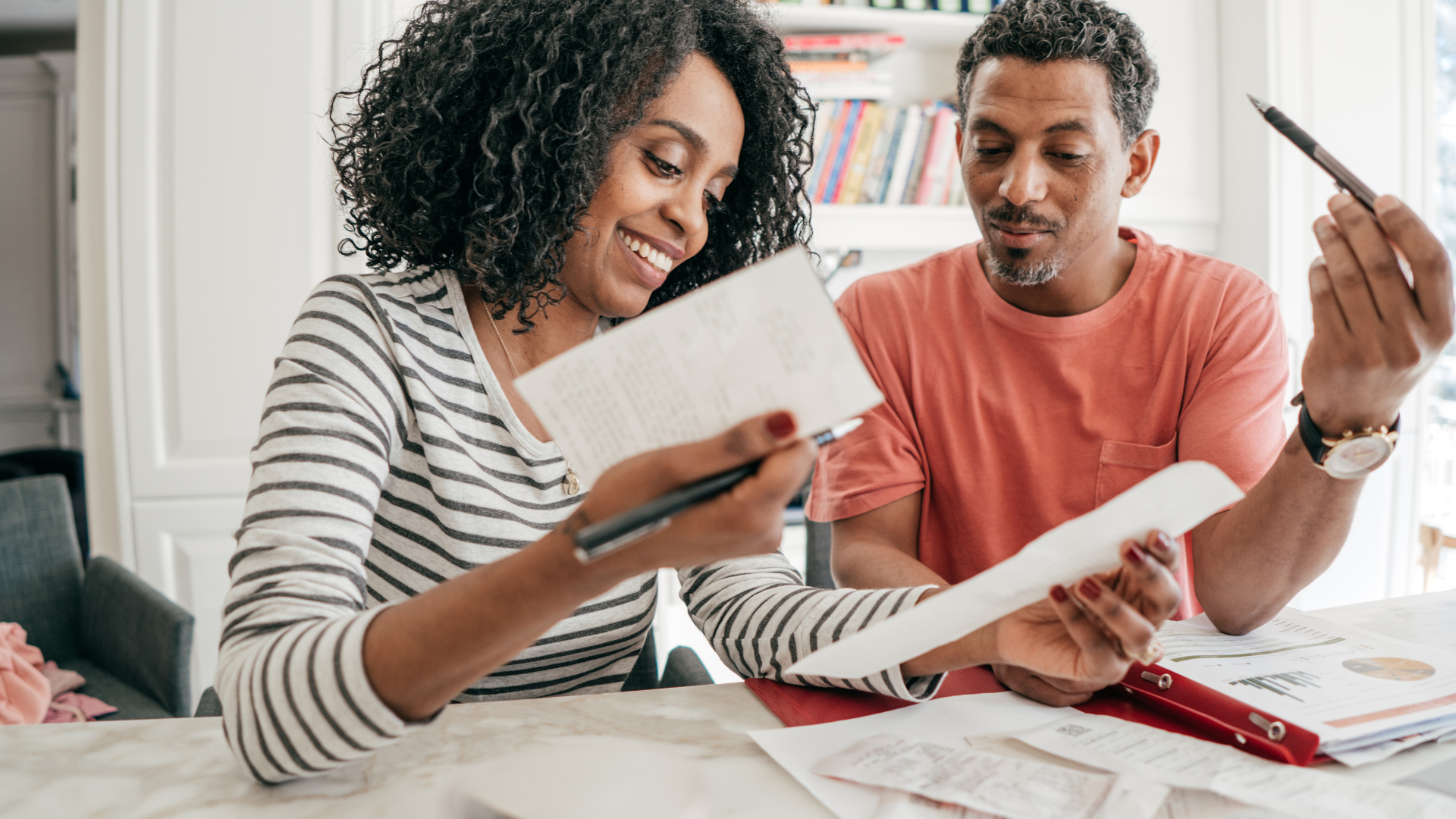

If you are at a stage in your life now where you need to save money, then you are probably thinking about how you can do it efficiently and effectively so that you are financially hitting the right marks for your personal wealth. It is important to set financial goals for yourself so you can feel confident with your money and can focus on long term financial health. No matter your financial goal, you should be able to achieve it by managing your current finances.

Why is it important to think about long term financial goals?

If you want to save money for a down payment for a house, or you plan on buying a car, maybe you want to send your kids to college, perhaps you need to budget your retirement savings, or, just maybe, you are looking to be debt free by a certain time, then building on your long term goals is an essential part of that.

Having your objectives in front of you with a plan can aid you in focusing on what’s important keeping you committed and motivated to meet them. If you need to go on a tight budget to meet these goals, then it will benefit you in the long run.

Bear in mind, whatever financial goal you have in mind, you still need to make way for an emergency fund and set a realistic plan that will help you stay committed without denying the existence of emergencies, which can happen to anyone.

Having a too-tight budget can be a hindrance in your life making you feel worried about the slightest thing. This will not help you, saving money should not be fear-inducing, it should make you feel happy about your future success, whether you initially have short term financial goals, medium term goals, or long term goals you need to put those concrete steps in place to support yourself and/or your family.

Steps to achieve your financial goals

Whether you are speaking to a financial advisor or plan on doing all your own financial planning, you need to think about the steps to take and how you are going to implement them. We will apply them to specifics soon, but for now, what steps need to be taken?

Setting your clear-cut goals

People can fail straight out of the gate when setting financial goals if they are too vague about what they want to save money for. If you say “I want to start saving money” to someone, that is quite ambiguous. What do you want to save for? Do you have a set amount in mind? You need to whittle that statement down to a focus – “I want to start saving money for my education.”

Once you have this exact goal in mind, you will be able to plan for it a lot better. When it comes to managing money, having a specific savings goal will keep you honed in on that particular thing. Whether you have it plastered over your kitchen on post-it notes, or have it programmed into a budgeting app, you need to make it an achievable goal.

Plan your timeframe

You may have long term objectives in mind, but you also need to think about those short term a medium term objectives too. Say you want to save $5,000 for a second-hand car, when are you planning on achieving that? If you say within the year (12 months) then you can break it down to reach your goals.

On average you will need to save $416 a month which is about $96 a week, or $13.70 according to My Money Coach. This is attainable if you look at what you are spending your money on daily/weekly/monthly. From this, you will be able to cut down in areas that you know are personally wasteful and help you achieve those money goals.

Keep your progress monitored

Being on top of your progress is incredibly important when you are saving. Keeping a detailed financial book with how much you have saved, maybe with an attachable pocket that has your money in, or setting up a separate savings account to transfer what you have saved that week/month will benefit your greatly.

If you are doing all this yourself or have the assistance of financial experts to help you reach those achievable goals, you will need to keep your own personal track too. If you are saving for something pretty large like buying a home or a renovation then you may need that extra bit of help to keep it all monitored, but if you feel like you can do this yourself and stay motivated throughout whilst maintaining focus on the finish line, then by all means, go for it.

What goals do people have?

There are many goals out there that people can set their sights on. Whether they are looking at basic budgeting, bringing in additional savings, getting out of credit card debt, or deciding on a retirement plan, all of it needs strategic planning so they can stay focused and look at moving forward with their choices. Of all the different goals, saving for retirement remains the main interest of most people. This is because everyone wants to have a sense of peace knowing that they can live their golden days in the manner they want, with enough funds in their account. They would have the liberty to decide whether they want to move to a senior living facility for better standards of living or simply hiring a few in-home care assistants (perhaps from the aged eastern suburbs) for the same purpose would do.

Creating a budget

Budgeting in general is a top financial goal that people strive towards. It is a great starting point for people who want to take control of their money for a myriad of reasons. Whether they want to make a budget for food shopping, car payments, bills, treats, and so on, they can do it by looking at their current outgoings and incomings and seeing what would be best overall.

Where to look

If you are wondering about how to manage money on a tight budget, you can go onto websites like Bankrate where they discuss student loans as well as saving on your rent. Obviously, it will depend on your specific budget and how you currently spend money, and what your current personal finances look like. But these points can still broadly help you in focusing on the proven benefits that budgeting has.

Paying off debt

Wished you were debt free? It’s no secret that there are many people out there worried about their debt, some are not even able to look at retiring early due to the fact they do not have enough savings because of their debt. If you are in debt with a bank or a loan company, then you need to meet with them to discuss what you can do to pay it off. For instance, you could look at –

- Paying off more than the minimum

- Paying off extra per month

- Keeping track of all bills – you can set bill reminders

- Making sure you pay off your most expensive loan

You need to focus on actionable behavior to pay off your debts, before you know it, your total debt will be paid off and you can breathe a bit easier. If you need to look at cutting expenses so you can make an extra payment that month, then do so. You’ll thank yourself in the long run.

Investing

Investing is a strategic approach to not only preserve wealth but also foster its growth over time. The realm of investments offers a diverse landscape, providing individuals with multiple avenues to explore based on their financial goals, risk tolerance, and preferences. Here are some prominent investment options:

Successful investing often involves diversifying across multiple asset classes to spread risk. Each type of investment has its own set of risks and rewards, and the key is to align the investment strategy with individual financial goals, risk tolerance, and time horizon. It’s advisable for investors to conduct thorough research or seek professional advice before making investment decisions.

Emergency fund

It comes as no surprise that emergencies pop up time and time again, and what makes it even worse is when you need to pay to sort them out. If you do not have the money to pay for your car breaking down, hospital/doctor expenses, or home issues, then you will find yourself wishing for a miracle.

You can be your own miracle by setting up an emergency fund that will, hopefully, cover you for anything that comes your way. Set a specific amount you want to initially save and put it away separately from your current account. Each time you get paid, or you get extra money from birthdays or Christmas, put a portion of it in there. You may not want to do all of that but just think of the long term and how useful it will be.

Retirement

When you reach retirement age, it should be a great time when you are able to kick back and put your retirement plan into effect. The retirement plan could include anything from traveling the world to living in a peaceful elderly community (learn more about it at www.chelseaseniorliving.com/locations/new-jersey/belvidere/). Post retirement, financial stability could be really necessary to get the necessary facilities and services since you may not have a steady income. However, if you have not set yourself up for retirement through investments and savings, then you will not be able to have that fun’ you’ve been longing for. There are a handful of retirement plans that you may want to check out such as

- 401(k)

- 403(b)

- Employee Stock Ownership Plans

- Profit-sharing Plans

- IRA

- Guaranteed Income Annuities (GIAs)

These are just some that can be looked into, there are other examples out there for you to explore if you want to go in-depth. Always do your research and see what is available in your area and what will contribute to your ultimate goal. Just remember that you should have enough funds in your account so that your options for senior living communities as well as traveling across the world (or any other preferences that you may have for your retirement years) remain open.

Owning a home

If you want to own a home at some point down the line, then you have to think about what money you will need for a down payment, initial expenses, mortgage payments, etc. Meeting with a real estate agent and going over your limit and what you can afford will help you see what else you could do. Whether you need more money, or you only have enough money for the down payment, an agent and broker will be able to assist you.

If you want to put down a pretty large down payment so you do not have to pay too much of a mortgage per month, you will need to see if that is something achievable for you. When setting financial goals for something like a house, you have to be precise and focused. This is one of those big financial decisions that should never be taken lightly.

Education

Whether you are paying for college yourself or your parents are paying for you, you will need to think of a plan to pay for it. College is pretty costly and can be quite a burden for people to pay. The amount of debt that people get into is pretty high, so starting a college fund early is crucial, especially if going to college is a serious goal of yours.

Websites like Saving For College have an article based on 6 ways to help pay for college, where they go into detail on areas like –

- College Savings Plans

- Federal Financial Aid

- Grants and Scholarships

- Cash From Savings

- Work During School

- Private Loans

So, if you need help with finding the different strategies that can help you set goals for your college experience, then you may want to research these areas further when you start your college-based financial planning.

Conclusion

Hopefully, this article has helped you with identifying what financial goals you want to set and how you can achieve them. Whether you put little effort in or you are focusing on how you can build wealth effectively, goal setting is always a crucial part of it. Consistently working on bettering your financial standing makes achieving your goals all the more sweeter.